Which of the following reimburses its insureds? This question lies at the heart of understanding the intricate world of insurance and the various ways in which individuals and organizations can protect themselves against financial losses. Reimbursement policies play a crucial role in determining the extent to which insurers are obligated to compensate their policyholders for expenses incurred due to covered events.

This article delves into the concept of reimbursement in insurance, exploring different types of reimbursement policies, methods of reimbursement, documentation requirements, and the impact of reimbursement on insureds.

As we navigate the complexities of reimbursement policies, we will uncover the advantages and disadvantages of various reimbursement methods, examine case studies of successful reimbursement strategies, and identify the factors to consider when choosing an insurance company for reimbursement. Ultimately, this comprehensive guide will empower readers with the knowledge and insights necessary to make informed decisions regarding reimbursement policies and ensure that they receive the financial protection they deserve.

Reimbursement Policies: Which Of The Following Reimburses Its Insureds

Reimbursement in insurance refers to the process by which an insurer provides compensation to an insured for expenses incurred as a result of a covered event. Reimbursement policies define the terms and conditions under which the insurer will reimburse the insured for such expenses.

There are different types of reimbursement policies, each with its own set of rules and requirements. Some common types of reimbursement policies include:

- Actual Cash Value (ACV): This policy reimburses the insured for the actual cost of replacing or repairing damaged property, up to the policy limit.

- Replacement Cost Value (RCV): This policy reimburses the insured for the cost of replacing damaged property with new property of comparable quality, up to the policy limit.

- Agreed Value: This policy sets a predetermined value for the insured property, which is the amount the insurer will pay in the event of a total loss.

Methods of Reimbursement, Which of the following reimburses its insureds

There are various methods used for reimbursement, each with its own advantages and disadvantages. Some common methods include:

- Check: This is the most common method of reimbursement, where the insurer sends a check to the insured for the amount of the claim.

- Direct Deposit: This method allows the insurer to electronically transfer the reimbursement funds directly into the insured’s bank account.

- Credit Card: Some insurers offer the option of reimbursing the insured via credit card, which can be convenient for smaller claims.

- Prepaid Debit Card: This method involves the insurer issuing a prepaid debit card to the insured, which can be used to cover eligible expenses.

Documentation for Reimbursement

Successful reimbursement requires proper documentation to support the claim. Essential documents include:

- Proof of Loss: This document provides details about the covered event, including the date, location, and extent of the loss.

- Receipts: Original receipts are required to prove the expenses incurred as a result of the covered event.

- Estimates: For repair or replacement costs, estimates from qualified professionals may be required.

- Medical Records: For health insurance claims, medical records are necessary to document the medical expenses incurred.

The specific documentation requirements may vary depending on the type of reimbursement and the insurance company.

Insurance Companies and Reimbursement

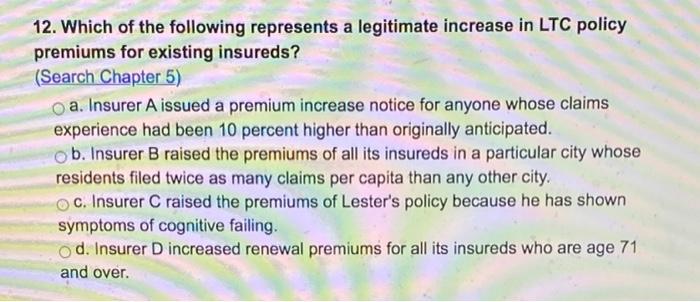

Numerous insurance companies offer reimbursement policies, each with its own coverage and benefits. When choosing an insurance company, it is important to consider factors such as:

- Financial Stability: The insurer’s financial stability ensures that they have the ability to fulfill their reimbursement obligations.

- Coverage: The extent of coverage offered by the policy, including the types of events covered and the limits of reimbursement.

- Customer Service: The reputation of the insurer for providing responsive and helpful customer service.

- Premiums: The cost of the insurance premiums, which should be balanced against the coverage and benefits offered.

Impact of Reimbursement on Insureds

Reimbursement policies can significantly impact insureds by providing financial assistance in times of need. Reimbursement can help cover the costs of unexpected events, such as medical expenses, property damage, or lost income.

Proper reimbursement can help insureds recover from covered events and minimize financial hardship. However, inadequate reimbursement or delays in payment can create financial difficulties for insureds.

FAQ Corner

What is the purpose of reimbursement in insurance?

Reimbursement in insurance serves as a means for insurers to compensate their policyholders for expenses incurred due to covered events, ensuring that they are not left with significant financial burdens.

What are the different types of reimbursement policies?

Reimbursement policies vary in terms of the coverage they provide, the methods of reimbursement used, and the documentation requirements. Common types of reimbursement policies include first-dollar coverage, coinsurance, and deductible plans.

How can I choose the best reimbursement method for my insurance needs?

The choice of reimbursement method depends on factors such as the type of coverage required, the level of financial risk tolerance, and the availability of funds. It is advisable to consult with an insurance professional to determine the most suitable reimbursement method.