Auto liability limits worksheet answers – In the realm of automotive insurance, the auto liability limits worksheet serves as a crucial tool for determining the appropriate coverage amounts for potential financial risks. Understanding the nuances of liability limits and their impact on financial well-being is essential for every driver.

This comprehensive guide delves into the intricacies of auto liability limits worksheets, providing clear explanations, practical guidance, and insightful analysis to empower individuals in making informed decisions regarding their insurance coverage.

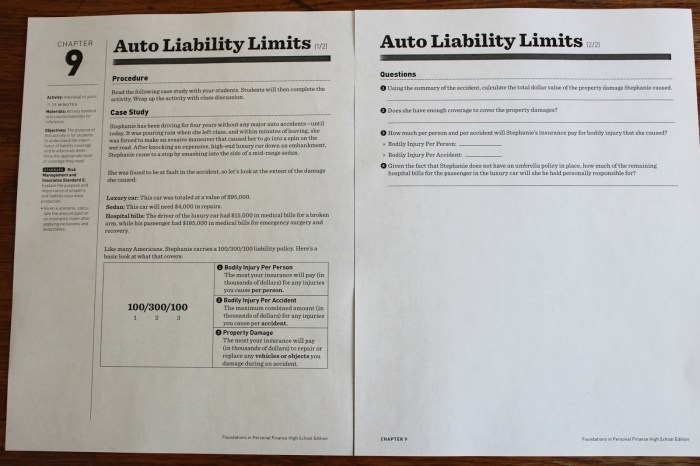

Auto Liability Limits Worksheet Overview: Auto Liability Limits Worksheet Answers

An auto liability limits worksheet is a crucial tool for determining the appropriate amount of liability coverage for an individual’s auto insurance policy. It helps individuals assess their potential financial risks and make informed decisions about the coverage they need to protect themselves and others in the event of an accident.

An auto liability limits worksheet typically includes the following types of coverage:

- Bodily injury liability: Covers the costs of medical expenses, lost wages, and other damages for injuries caused to others in an accident.

- Property damage liability: Covers the costs of repairing or replacing property damaged in an accident, such as vehicles, buildings, or other objects.

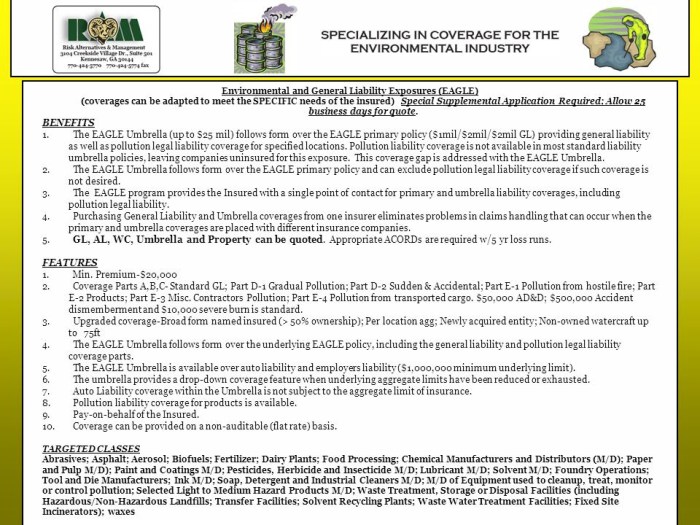

- Uninsured/underinsured motorist coverage: Provides protection in case of an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Understanding Liability Coverage Amounts

Determining appropriate liability limits is essential to ensure adequate financial protection. The following factors should be considered when setting liability limits:

- Assets: Individuals with significant assets, such as a home, savings, or investments, may need higher liability limits to protect their assets from potential lawsuits.

- Income: Individuals with higher incomes may need higher liability limits to cover potential lost wages or earning capacity in the event of an accident.

- Driving habits: Individuals with poor driving records or who frequently drive in high-risk areas may need higher liability limits to mitigate the potential for accidents and financial consequences.

Calculating Liability Limits

To calculate liability limits, individuals can use the following formula:

Liability Limit = Assets + (Income x Years of Earning Potential)

For example, an individual with $200,000 in assets, an annual income of $50,000, and 20 years of earning potential would have a liability limit of $600,000 ($200,000 + ($50,000 x 20)).

Worksheet Completion Instructions

To complete an auto liability limits worksheet, follow these steps:

- Gather necessary information, including assets, income, driving history, and desired coverage levels.

- Determine the appropriate liability limits using the formula or by consulting with an insurance agent.

- Fill in the worksheet with the calculated liability limits and any additional coverage options desired.

- Review the worksheet results and make adjustments as needed.

Interpreting Worksheet Results

The results of an auto liability limits worksheet provide individuals with a clear understanding of their coverage and potential financial risks. Higher liability limits offer greater protection but also come with higher premiums. Individuals should carefully consider their individual circumstances and financial situation when interpreting the results.

For example, an individual with a low net worth and limited driving exposure may opt for lower liability limits, while an individual with significant assets and a history of accidents may need higher liability limits to protect their financial interests.

Additional Considerations

Beyond liability limits, individuals should also consider other factors when making auto insurance decisions, such as:

- Uninsured/underinsured motorist coverage: This coverage protects individuals in the event of an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

- Medical payments coverage: This coverage helps pay for medical expenses for the policyholder and passengers, regardless of fault.

- Collision and comprehensive coverage: These coverages provide protection for the policyholder’s own vehicle in the event of an accident or other covered event.

Individuals should consult with an insurance agent or broker to discuss their specific needs and determine the most appropriate coverage options.

Detailed FAQs

What is the significance of an auto liability limits worksheet?

An auto liability limits worksheet is a valuable tool that assists individuals in determining the appropriate coverage amounts for their auto insurance policies. It enables them to assess their potential financial risks and make informed decisions to ensure adequate protection against liability claims arising from accidents.

How do I determine the appropriate liability limits for my auto insurance policy?

Determining appropriate liability limits requires careful consideration of several factors, including assets, income, driving habits, and the potential financial impact of an accident. The worksheet guides individuals through these considerations, helping them establish limits that align with their specific circumstances.

What steps are involved in completing an auto liability limits worksheet?

Completing an auto liability limits worksheet involves a series of steps that assess assets, income, driving habits, and potential financial risks. The worksheet provides clear instructions and formulas to assist individuals in calculating appropriate coverage amounts.

How do I interpret the results of an auto liability limits worksheet?

The results of an auto liability limits worksheet provide individuals with a clear understanding of their potential financial risks and the adequacy of their current coverage. It helps them assess whether their limits are sufficient to protect their assets and income in the event of an accident.